Is it Time to Panic?

Wifey was checking out her Chinese Twitter/Facebook clone when she noticed a post from one of her co-workers. Seems the stock sell-off the past couple of days caused her co-worker to lose a good chunk of her portfolio.

Additionally, her co-worker posted that her father's stocks were also hammered by the sell-off and took a bigger beating at the hands of the market.

Wifey asked me how our "stocks" were doing. Not knowing the exact answer, I guessed we were probably down 2% for the past two days. That would have been the end of it, but now I was curious. Since the NDPs won the election in Alberta on Tuesday night, I guess that made people think about all the taxes that would be levied on the oil companies. In turn, all the profits would disappear from oil companies, banks, and even tech companies. Obviously, it was the time to sell, sell, sell! I wondered if maybe my 2% estimate was too optimistic... if maybe we took a big beating without us knowing it.

I totalled up all the number and plugged them into my spreadsheet.

The result? We're down 1.75% for the past two days.

Huh.

Certainly not the gloom and doom I was expecting based on my wife's co-worker's post.

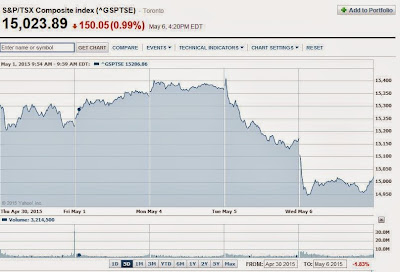

Here's the TSX index over the past 5 days.

Seems the market was chugging along and something happened on Monday night or Tuesday morning that started some kind of drop in stock prices. It looks very dramatic, but in reality it's only a drop of 1.83% from April 30. That's nothing compared to the 10% correction we sustained last September.

In comparison, let's look at the TSX index for 2015.

In reality, the TSX is actually up 1.83% for the year. Using our own numbers, our portfolio is up 3.87% for the year.

So how is it that other people are down so much?

A couple theories come to mind.

First, not everyone is index investing. In this case, wifey's co-worker may have been invested in energy companies and financial companies. Possibly by means of mutual funds or even by holding the stocks directly. This co-worker's father might have been heavily invested in stocks, which is why he got hammered the last couple of days.

Second, people might have just focused on the past couple of days. I mean, wow! My own number of 1.75% down the past two days is quite large. Considering the average return is around 9% a year, 1.75% is a decent chunk of that. However, if you look at the YTD, the 1.75% down still means an overall gain of 3.87%.

Would I prefer the 5.62% gain I had a couple of days ago? Sure. But I'm not looking to use the money now, tomorrow, or even next year.

As such, it really doesn't matter to me what the value of our portfolio is. What matters is how many ETF and mutual fund units we own.

Despite the 1.75% drop in prices, I lost 0% of my ETF and mutual fund units. That's right zero.

As long as I hold onto these units, it'll allow time for the prices to recover. Maybe it won't recover in the next 2 days or 2 months, but generally speaking, the prices will go up because the underlying companies will still make money.

In fact, I even purchased additional units of the TD e-series fund this morning with zero regrets. It is important to note that I'm not buying additional units based on the price dropping (market timing is a no-no), but based on a set schedule that I planned two weeks ago.

As I write this, the value of our portfolio is back up 0.32%.

Which is a shame considering I was hoping prices would remain depressed until I received confirmation of purchasing the e-series funds.

The TSX is still dropping, though.

Additionally, her co-worker posted that her father's stocks were also hammered by the sell-off and took a bigger beating at the hands of the market.

Wifey asked me how our "stocks" were doing. Not knowing the exact answer, I guessed we were probably down 2% for the past two days. That would have been the end of it, but now I was curious. Since the NDPs won the election in Alberta on Tuesday night, I guess that made people think about all the taxes that would be levied on the oil companies. In turn, all the profits would disappear from oil companies, banks, and even tech companies. Obviously, it was the time to sell, sell, sell! I wondered if maybe my 2% estimate was too optimistic... if maybe we took a big beating without us knowing it.

I totalled up all the number and plugged them into my spreadsheet.

The result? We're down 1.75% for the past two days.

Huh.

Certainly not the gloom and doom I was expecting based on my wife's co-worker's post.

Here's the TSX index over the past 5 days.

|

| Oh my gosh! The horror! |

In comparison, let's look at the TSX index for 2015.

|

| Huh. We're actually doing relatively well. |

So how is it that other people are down so much?

A couple theories come to mind.

First, not everyone is index investing. In this case, wifey's co-worker may have been invested in energy companies and financial companies. Possibly by means of mutual funds or even by holding the stocks directly. This co-worker's father might have been heavily invested in stocks, which is why he got hammered the last couple of days.

Second, people might have just focused on the past couple of days. I mean, wow! My own number of 1.75% down the past two days is quite large. Considering the average return is around 9% a year, 1.75% is a decent chunk of that. However, if you look at the YTD, the 1.75% down still means an overall gain of 3.87%.

Would I prefer the 5.62% gain I had a couple of days ago? Sure. But I'm not looking to use the money now, tomorrow, or even next year.

As such, it really doesn't matter to me what the value of our portfolio is. What matters is how many ETF and mutual fund units we own.

Despite the 1.75% drop in prices, I lost 0% of my ETF and mutual fund units. That's right zero.

As long as I hold onto these units, it'll allow time for the prices to recover. Maybe it won't recover in the next 2 days or 2 months, but generally speaking, the prices will go up because the underlying companies will still make money.

In fact, I even purchased additional units of the TD e-series fund this morning with zero regrets. It is important to note that I'm not buying additional units based on the price dropping (market timing is a no-no), but based on a set schedule that I planned two weeks ago.

As I write this, the value of our portfolio is back up 0.32%.

Which is a shame considering I was hoping prices would remain depressed until I received confirmation of purchasing the e-series funds.

The TSX is still dropping, though.

Comments

Post a Comment