Putting All Your Eggs in One Basket

|

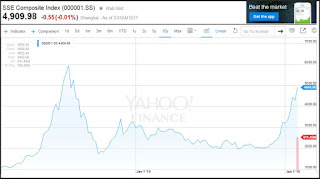

| Shanghai Stock Exchange on June 3, 2015 |

A couple of weeks ago, June 3rd to be exact, wifey suggested we invest some money into the Chinese stock exchange. Of course, she meant investing in the Shanghai stock exchange, but I knew what she meant.

Apparently, at that time the Shanghai stock exchange was making an incredible run from the start of the year. It was all the rage among her friends in China. They were all investing and talking about how much money they had made.

Wifey was feeling like she was missing out. As a result, I went on Google and tried to figure out what she was talking about.

It appears after hovering around 2,000-3,000 since the crash about 8 years ago, the market had jumped up to almost 5,000!

I was impressed.

However, not so impressed that I blindly threw money into China.

After what happened in 2007/2008, I was mindful that a repeat could follow. In 2007, wifey was caught up in the madness as well. Only that time, she decided she wanted to invest 5,000 RMB (closer to $800 Canadian at the time. Assuming an exchange rate of 6.30 RMB / 1 CAD). Her co-workers were "making" incredible gains on the stock market each day and she wanted a piece of the pie. Of course, we know what happened afterwards, the market crashed. Her 5,000 RMB was whittled down to 3,000 RMB. Overall, it was a learning experience for the both of us. We were fortunate in that wifey only invested 5,000 RMB and not 100,000+ RMB like some of her co-workers. Last year, we finally sold her investments. We got around $700 Canadian (I'm guessing it was about 3,500 RMB at the time, I forgot. Just assuming the exchange rate was about 5 RMB / 1 CAD) and we invested that in investments here.

I told wifey how the market was beginning to look like 2007/2008 all over again and showed her the chart above.

I also told her that if we were to invest in China, we'd need to adjust our allocations. Currently, we're investing 20% of our money in International ETFs and mutual funds. I didn't want to lower this percentage (if anything, I've been thinking of increasing our exposure to the US and International markets and lowering the exposure to the Canadian market). I also told her that our international holdings weren't doing poorly. From last year's correction, our international holdings were up 20%. Granted, it wasn't the 100% gain in Shanghai, but still a decent gain.

We'd also need to purchase an emerging markets ETF (as I couldn't find an only China ETF), so we'd get exposure in other countries as well as China. Countries like India, South Korea, Malaysia, South Africa, etc.

Any money we allocate, I didn't foresee us putting more than 5% into this ETF. The emerging markets make up a small percentage of the world's stocks (another reason I'm thinking of lowering our Canadian exposure. Canada's stocks make up something like 4% of all the world's).

Additionally, similar to 2007/2008 with her former co-workers, her friends weren't actually making money unless they sold their stocks/funds. I told her, since we were long term investors, that strategy wasn't for us since we buy, hold, and collect the distributions.

Finally, I told her of a joke I read in The Wealthy Barber Returns. Where the author recounts a story shortly before the market crash in 2008. He said that year, teachers were asking him about stock market investing. In his experience, teachers were the most conservative of investors. He joked the fact that teachers were interested in investing in the stock market meant it was time to sell.

I told wifey that the fact she was interested in investing probably meant it was time to sell.

She agreed with my points (and wasn't interested with investing in the other countries in the emerging markets fund) and went on with her day.

Two days later, the Shanghai stock market started to drop. It's still early to say where it's going, but last week, the drop made the business news. Apparently, last week alone, the market dropped 13% and officially became a correction! Wifey told me her friends were saying how they lost all the money they gained!

I logged in this morning and saw for myself. Ouch?

Although, 13% down seems harsh, really the market is still up at least 100% for the year. This is assuming you've been invested for a while now and not just joining when everyone was joining.

This reinforced the fact the need to diversify. If wifey's friends invested in bonds/savings terms in addition to stocks, they might have escaped some of the pain of losing their gains.

If they employed a simple 50% bonds and 50% stocks strategy, they would have been buying more bonds when stocks were going up. Actually, they may have been forced to sell some of their stocks in order to maintain the 50-50 split! This meant they'd would have been forced to sell stocks when they were high. I don't know if they have bond funds in China. At minimum, they have savings terms (similar to GICs) they could invest in.

Another diversification problem is the fact that her friends were stock picking or invested in mutual funds that reflected a part of the market (wifey's mutual fund choice in 2007 was large cap stocks) and not the whole market.

I don't know where the market in Shanghai will go. Maybe this correction was a blip before a decades long sustained rise. Maybe this correction is a precursor of what is to come (more dropping until it goes back to the 2,000-3,000 range).

Either way, you need to diversify your portfolio and mitigate the risks of stock market investing.

Comments

Post a Comment