Receiving Free Money with an RESP

|

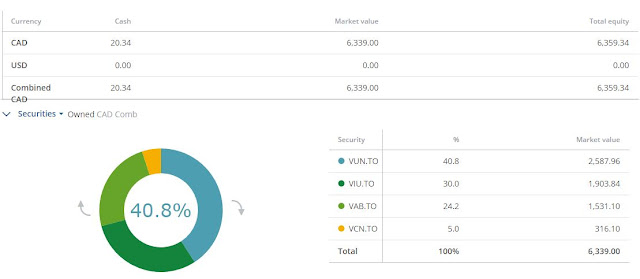

| Baby girl's RESP is already over $6,000. |

The first thing we did after the account was opened was to take advantage of the free government grants. How do we do that? Well, by funding the account.

There were two grants that we could take advantage of.

First was the basic one called the Canada Education Savings Grant (CESG). This one, you can receive an extra 20% on top of your contribution on your first $2,500 of contributions for that calendar year. Strictly speaking, that means you can contribute $2,500 a year to maximize the amount you can receive in the form of grants. If you contribute more than that, you would still only receive the grant on the first $2,500. Even if you contributed $5,000. There are some exceptions. Like if you missed a year and are catching up. However, as baby girl was born late in 2016 and we wanted the money in the account ASAP, we contributed $2,500 in November.

The second grant is called the Additional Canada Education Savings Grant (A-CESG). This one can give you an additional 10% or 20% in grants on your first $500 of contributions depending on your net income for the previous year. To summarize, this is how it works.

- $100, if net family income is $45,282 or less ($500 x 20% = $100)

- $50, if net family income is between $45,282 and $90,563 ($500 x 10% = $50)

Once you deposit the money into your account, expect to receive the RESP grants at the end of the following month. So if you deposited the money in November (like us), you will receive the money at the end of December. We received $550 in grants for a $2,500 contribution. That's a 22% ROI just by opening and contributing to a RESP.

Fortunately for us, baby girl was born in late 2016. As a result, after receiving our first grants, it was already 2017 and time for additional contributions.

|

| The grants we received in February for January's contribution. |

As tax filing season doesn't open until mid February, our income for 2016 wasn't yet known. As a result, we would have a short time frame to qualify for the A-CESG as wifey's income increased our net family income well past $90,563 for 2016.

On January 20, I contributed an additional $2,500 (upping our contributions to the RESP to $5,000) and we received the grants at the end of February. Another $550, giving us a lifetime total of $1,100 in grants.

Baby girls' RESP is currently worth $6,359 or so. That's an increase of $1,359 on top of our initial contribution. That's a 27% ROI. Amazing.

There's not many investment products that can guarantee a 20% return. That's what makes the RESP a superior product to invest in your child's education.

Of course, there are some caveats. First, the lifetime amount of grants you can receive is $7,200. If you go by the 20% CESG, that means you can only contribute $36,000 to max the grants. However, the lifetime amount you can contribute is $50,000.

Which doesn't make much sense at first glance. However, another reason for the RESP is income splitting. More specifically, between parent and child.

Any non-contribution money (grants, interest, capital gains) withdrawn from an RESP is taxed to the beneficiary. The child. As it is assumed the child will be working part time (or not at all!), they will be in the lowest income bracket. Or possibly in the income exemption range (something like $10,000 in Ontario). Which means, that income will not be taxed later on. Free money!

Any contributions can be withdrawn tax free. As the contributions are from after tax income, it is assumed the contributor already paid taxes on that money.

Another caveat is that the money can only be withdrawn for education purposes. Your kid decides to become a musician? An athlete? The next start-up guru? An RESP isn't for them.

So what happens if they don't pursue post-secondary education? Well, you don't have to close the plan until the year they turn 35 (or something like that). Who knows? Maybe later, your child might decide to take up a new career and will require the funds in the RESP when they are 32.

Worst case scenario, you close the plan, return the grants to the government (and gains on those grants), and get taxed on the capital gains on your contributions. If you have the RRSP room, then you can transfer these amounts over without being taxed. At least not until later.

If you plan on being retired by the time your child is 35, then you probably don't need to worry about this part of the RESP.

Did I mention the free money? Woohoo!

(*cough* only if they continue studying after high school*)

*As per the Government Canada website.

After high school, your child can withdraw the money to help pay for either full-time or part-time studies:

- in an apprenticeship program;

- at a CEGEP;

- at a trade school;

- at a college; or

- at a university.

That's a lot of options.

Comments

Post a Comment