Sold The TFSA to Purchase a 2nd Condo!

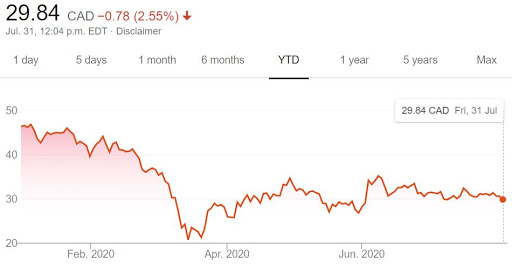

Took 3 months of searching It finally happened. After looking for 3 months, the mother-in-law purchased a condo (a 5 minute walk from the Loonie household, talk about convenient for wifey!) for her and father-in-law to live in. They were able to transfer money from China to help fund their purchase, but they needed our help with the rest of the money. As a result, wifey and I sold, essentially, all of our holdings in the TFSA. Over $250,000 worth of ETFs sold from our Questrade accounts. It feels like a huge step backwards in our FIRE journey. However, if it helps get the in-laws out of the house, there's no price on that. Some of the ETFs we sold Don't misunderstand me. It was useful for them to be with us for the birth of Loonie Girl. However, now that she's growing up and her own person, she doesn't like hanging around them anyway. She prefers to hang around wifey and myself. With the in-laws out of the condo, that means Loonie Girl moves into the in-laws old room an...