Whoops! I Forgot. Most People Are Terrible With Money

|

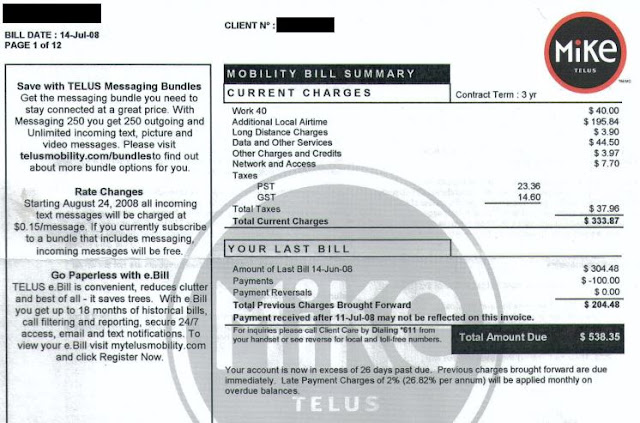

| What a doozy of a phone bill... |

I reached in and dug it out. Surprisingly, the bill wasn't too dusty. I looked at the first page and was surprised.

You see, after 3 years of cutting expenses and running a fairly efficient household, I forget how bad people are with their money.

In this case, the total owing on the phone bill was $538.35!

Okay, it looks bad. Maybe it was just a busy time at work. It appears this phone bill is for a work plan.

As I scanned the lines in detail, I noticed that the current's months charges were $333.87 and the previous phone bill was actually $304.48. Unfortunately, the previous owner only put $100 towards the previous bill. Ouch!

Okay, maybe the interest charges aren't so bad. I mean, it's just a phone company right? I scanned the bill for details on interest to find that Telus (at the time) charged 2% per month! Or 26.82% each year!!

26.82% interest! What a great return! For Telus I mean.

26.82% is ridiculously high. Granted some credit cards charge more than 26.82%, but the majority charge 19.99% on an annual basis.

Why couldn't the previous owner put the bill on their credit card and get some relief? Well, the previous owner could have done that... assuming they had room on their credit card.

This bill was during the middle of the financial crisis. Most likely, the work that supplied the income for the previous owner was drying up as everyone was protecting their assets.

Even thinking up reasons for this bill, the first thing that comes to mind is having an emergency fund for situations such as these. If I was self employed and relied solely on my ability to get and maintain work, I'd want an emergency fund to at least be able to tide me over for 6 months at minimum!

Three years after starting down the road of index investing, the total value of wifey and my investment portfolios is well over $200,000. Assuming markets crash overnight by 50% and both wifey and I lost our jobs, we'd have enough money for 2 years.

Yes, many experts and other people advise having an emergency fund in cash... We do have cash as well. We have at least 1 month's worth of expenses in cash at all times. We also save money for our yearly lump sum insurance payment. However, we'd rather keep the majority of our assets in higher potential return investments than a bank account that pays pennies each month. If we need money, we'd just sell some of our investments like we have done in the past.

Wifey's friends in China recently immigrated to Canada. As such, they asked for advice in order to set up things like bank accounts, investment accounts (like an RESP for their own daughter), and mobile phone service.

I advised them that, in our experience, we don't need much from banking aside from being able to direct deposit, withdraw cash, transfer money, and pay bills. As such, I said that Tangerine was good for that. They, unfortunately, went with RBC. A bank that has a history of overcharging fees. I understand why they went with RBC, though. Apparently, RBC has branches in China that makes it easier for them to do banking in Canada and back in China.

In terms of the RESP for their daughter, they told me they were going to see an advisor at RBC. I told them that no matter what the advisor told them to invest in, they'd be paying too much in fees. I advised them that opening an RESP account at Questrade and investing in low-cost index ETFs was the best way of getting the most of their money. Unfortunately, again, they didn't listen to me.

For their mobile phone, they asked me which company has the best deals. I told them about Zoomer Wireless and how they can go about setting that up. While not the best deal, their plans are decently priced and there's the option in the future of signing up with a loyalty plan (a good deal). Unfortunately, they needed the phone immediately (as opposed to two days later) and "free" iPhone. *sigh*

Did I mention, they already have two iPhones? Now they have four.

Of course, that's not all the advice they ignored.

When's the best time to get a cheap TV?

Black Friday. It's coming in 6 weeks or so.

Oh, but I can't wait that long. I'll just get this 55" Smart TV*.

How do you get cheap groceries?

Well, you look at the flyer and figure out the cheapest prices for each item you need and get it there or price match with other flyers.

Oh, we'll just go to Walmart.

Which TV box do you use?

We don't watch TV.

*blank and confused stares*

Should we just get Rogers?

*blank and confused stare*

So why are you asking for advice?

Whatever, I suppose the problem is people don't realize that our savings rate is over 50% or that we've managed to accumulate over $200,000 in our investment accounts in just over 3 years (starting with around $40,000 in cash and registered savings accounts).

Or maybe it's because we don't have a lot of toys for baby girl or that our house is modest and sparsely furnished. I don't know.

Of course, that doesn't mean I'll stop trying to help or offer advice when asked.

*It's important to note that the guy didn't even know what a smart TV was or how it worked. I guess the sales person did a good job.

Comments

Post a Comment