What Your Commute Is Costing You

|

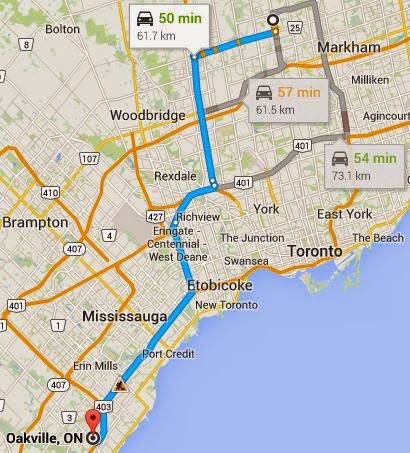

| The possible routes from Richmond Hill to Oakville. |

After being without a job for about 9 months, she just started a new position at a company in Oakville.

She currently lives in Richmond Hill.

For those who don't know, Richmond Hill and Oakville are quite far apart.

Under ideal conditions, this is a 50 minute commute one way.

However, driving through Toronto means you're rarely driving in ideal conditions. Expect to add 30 minutes to this drive for a total of 2 hours and 40 minutes there and back!

Yikes!

She previously worked in downtown Toronto so she took the train to work everyday. The trip from Richmond Hill to Toronto Union Station is about 48 minutes. The total round trip is 1 hour and 36 minutes long. This new job is adding an extra 1 hour to her commute.

What could you do with an extra hour a day? Ride your bike? Play with your kids? Spend time with your SO?

Since I'm the Loonie IT Guy, let's think about costs too!

The previous commute would have cost on average $240 a month for a train pass. With the Government's 15% tax credit for transit passes, this cost is approximately $204.

For the new commute, we'll need to make some assumptions. Let's assume she drives a car like mine and gets 8.1L/100km for fuel economy. Let's also assume the price of gas is an average of 132.9 cents/L. To calculate the cost of the daily commute, we just multiply the total distance (123.4 km) by the fuel economy (8.1L/100km) and by the average price of gas (132.9 cents/L).

If you have a calculator handy, you'll end up with 1328.4 cents a day for gas. We can move the decimal a couple of places and end up with $13.28 a day!

Yowsa!

Assuming there is an average of 22 working days a month, that leaves us with $292.16 a month just for gas.

But wait, there's more!

Now that the car is being used to commute to work 123.4 km a day, she'll also need to update her auto insurance. I have no idea how much more that would cost. Let's just assume a flat $50 a month increase.

We're not done yet!

With the increased driving, that means more wear and tear on the vehicle. Some people say wear and tear costs more per km than gas. Let's be optimistic and assume it costs the same as gas. That will be another $292.16 a month (or $3,505.92 a year for car maintenance and repair).

For this new job, it'll cost $634.32 a month compared to $204 a month at the old job.

That's a difference of $430!

Now, granted wifey's friend has no choice in the matter. Bills need to be paid and they can't live on savings forever.

However, what if you had the choice. What if you were looking for a new job and was offered this new job in Oakville, would you take it?

Would you take it knowing you would need to spend an extra hour commuting? Would you take it knowing you need to spend an extra $430.32 a month or $5,163.84 a year?

If you're switching jobs based on a higher salary, are you sure you're getting a higher salary?

If you're being paid $50,000 a year at your downtown job, how much of a pay increase would you need to make the switch? If this tax rate is 40%, that means you'll need an increase of at least $8,606.40 a year to match your previous after tax income after commute costs. We need to do this since all our expenses (gas, insurance, car maintenance, etc.) are paid with after tax dollars.

If you get a pay raise to $60,000 a year, that means you'll only be taking home an extra $69.68 a month! ($10,000 raise is $6,000 after tax. Subtract $5,163.84 for new expenses and we're left with $836.16 more. Divide by 12 and that is how much we get more per month.)

Now divide that $69.68 by the 22 more hours extra you're commuting a month. That means you're only paying yourself $3.17 for that hour of commuting.

That hour you're giving up to get to that new job is only worth $3.17.

The minimum wage in Ontario is $11 an hour. Surely, your time is worth more than minimum wage.

Of course, if you're getting a $20,000 pay increase to $70,000 a year, that hour is now worth $25.89!

Most people just think of time as the only cost of their commute. When contemplating a new job, we should also consider monetary costs as well.

Of course, in this economy, most people aren't too picky with the jobs they are offered.

Comments

Post a Comment