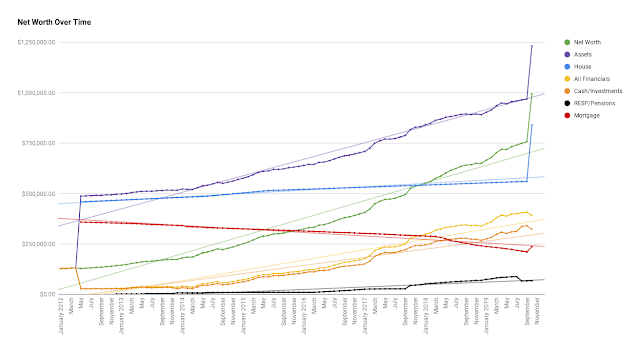

Net Worth Update October 2019

|

| Net worth as of October 31, 2019 |

The other changes are that both wifey and I changed jobs. Our household income is much higher than it was when I first started to write this blog. So although we had to pay things like land transfer taxes (twice because Ontario and Toronto want their cuts) and closing fees, it was mainly covered by our salaries, TFSAs, and wifey's pension payout (more on that later).

Overall, the amount of our savings and investments decreased by $1,200 or so. Not a lot when your total is almost $400,000. The big drop came in the Pension side.

When Wifey left her old job, her work pension sent her options to determine what she wanted to do with her defined benefit pension.

Normally, a defined benefit pension is a very good deal. Her pension in particular was also indexed to inflation. However, she wouldn't be able to start benefits until she was 63. Which is silly in a way because our goal was to retire early. If we do manage to retire early, then the money she receives each year of this pension won't be much anyway.

Anyway, here were the options:

- Leave the money with her pension group. Start collecting at 63.

- Transfer the money/credit to another employer that uses the same pension group.

- Transfer the money to another pension.

- Transfer the money to your own LIRA.

We chose to transfer the money to wifey's LIRA. In order to do that, we set up a LIRA account at Questrade and had them initiate a transfer from wifey's pension group. After a couple of weeks, the transfer was complete. However, the Government has set limits on how much can be transferred. As a result, not all the money was transferred. Instead some of the money was given to us back in the form of cash (after taxes) due to over contributions and excess based on the maximum amount transferable. It's actually a little complicated. The amount they calculated also wasn't the amount of her and her employer's contributions. It was based on the amount she would earn in retirement and how much they calculate she would need to earn that amount in retirement based on a certain rate of return.

Anyway, the main result of this is that her pension amount dropped (even though I'm counting the LIRA as pension since she cannot touch this money until she's 55 or 65). We used the cash portion to help pay for some of the closing costs involved with our real estate transaction.

In terms of what we owe, our remaining mortgage went up because we took on a bigger house. We brought our old mortgage down to $210,000 or so, but then picked up a $240,000 mortgage on the condo in downtown Toronto because I didn't want to dip into the TFSAs. Especially considering our mortgage rate is only 2.39% over 5 years! This is a fixed rate. Plus, this 2.39% was only available for two weeks or so before the rate moved back up. So yes, we took on a higher mortgage, but I'm hoping with the higher salaries and lower interest rate, we'll be bringing the mortgage down pretty quickly. Already, we've been paying $1,000 or so a week towards the mortgage. Our weekly payment is supposed to be $400. By the next 6 month update, I hope to have the mortgage amount to less than $210,000. Realistically, it should be under $215,000.

These last two months after we've moved, we've been spending money to make our new home more like a new home. Gone are some of the old things and replaced with some newer things. For instance, we purchased a Vitamix in order to throw away our food processor (kind of broken) and blender (broken, but we still made it work). We purchased some new lamps to brighten up the condo because for some reason, new condos don't have lights from the ceiling. Some new LED bulbs to replace some of the incandescent bulbs in a chandelier. We also plan on replacing the current microwave/range hood combo with a range hood better suited for Chinese cooking (makes the kitchen feel greasy). Plus, we purchased a twin size loft bed for BG's room as it's not big enough to hold a full size loft. We'll also need to purchase a new mattress. As a result of these expenses, we likely won't be able to max out the TFSAs in the new year right away. However, we should still be able to max our BG's RESP and put a decent dent into our $42,000 of TFSA contribution room ($30,000 was withdrawn for the down payment in August and $12,000 of new room for 2020).

Overall, I don't see us spending much more money on anything else as we don't have the room to keep anything. We would need to throw stuff out first (because it's unusable or completely broken) before we buy something new.

The following is a summary of the numbers for the October 2019 update:

- Net worth: $994,353.33 (+$275,258.22)

- Total Assets: $1,231,631.18 (+$282,771.57)

- Estimated House Value: $840,000.00 (+$283,999.19)

- All Financials: $391,631.18 (-$1,227.62)

- Cash/Investments: $323,429.03 (+$14,672.13)

- RESP/Pensions: $68,202.15 (-$15,899.75)

- Remaining Mortgage: $237,277.85 (+$7,513.35)

Comments

Post a Comment