How the Ontario Registered Pension Plan Affects Potential Early Retirees

|

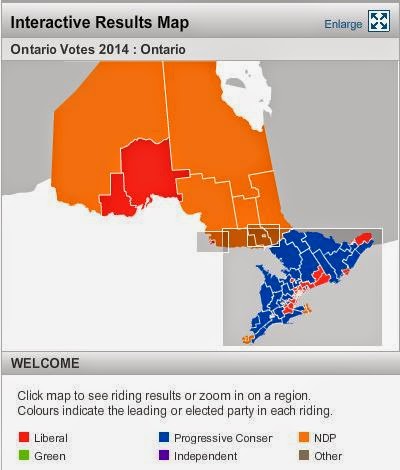

| Looks mostly blue and orange, but red (like the population) is concentrated in the major cities. |

Even if you're not superstitious, there are plenty of things to be scared of today. If you're planning an early retirement like I am, I can give you one example right now that will affect our financial future.

Ontarians are waking up to a Liberal majority government. (I hope you voted last night!)

I don't follow politics very closely, but one thing in the Liberal election platform was the proposed Ontario Registered Pension Plan (ORPP).

In this proposed plan, essentially, the Ontario government will take 1.9% of workers paycheques (matched by the employer), use that money to invest, and then distribute those returns to workers after they retire at age 65.

In one of the examples given, a worker who contributes ($71 per month) to the plan from 25 to 65 with an average annual income of $45,000 per year will get $6,410 per year ($534 per month) for the rest of their retirement until death.

This is great. Except, there's a serious problem that's overlooked. People won't be eligible to take the money out until the year 2059. If you were born in 1994 or later, this won't be a problem for you. For those who were born before, you won't be eligible for the payouts until after your retirement.

If you're like me and plan to retire much earlier than 65 and were born (well) before 1994, you have two problems now.

- You're going to have to wait much longer between the year you retire to the year you are eligible for payouts. In my case, assuming I retire at 50, I'll have to wait 28 years.

- The amount you contribute will be less as you're not that guy working 40 years anymore. You're working 20? 15? Even 7 years before you retire? That means the amount you will receive (if you're even eligible to receive payments) will be much, much less. If you're not eligible to receive payments, you can kiss your money good bye.

But wait! There's more. The proposal is based on the assumption that the average Ontarian is paying 2% MERs on mutual funds so they'll get a better deal putting their money with the government and their low (assumed) MERs of 0.3%.

However, as people striving for early retirement, we're not the average Ontarian! Wifey and I currently have most of our money in a mixture of Vanguard and iShares ETFs. The calculated MER for our portfolio is only 0.182%!

|

| MERs as of June 13, 2014 |

For the average Ontarian just graduating post secondary school in a couple of years, the ORPP will help them if they don't have a workplace pension and if they contribute to the plan for 40+ years.

For the exceptions like ourselves, who strive to retire well before 65, this plan is essentially another deduction on our pay that we'll never see.

Personally, I think it would be cheaper to force students to take a course in Personal Finance to take care of their money. The government already requires English and Math in college. Why not Personal Finance?

Oh well, can't really complain. Just need to tack on a couple for working years to the early retirement plan. If I can find a way to earn a little bit extra each month or cut back on spending, I could offset this additional deduction without a change to my projected retirement timeline.

There is also one more thing to be scared of.

If the above wasn't bad enough, tonight is also a full moon.

Better stay out of the downtown core tonight.

Comments

Post a Comment