As a continuation from

this post, yesterday was the day to sell the old funds and purchase the new funds without penalty.

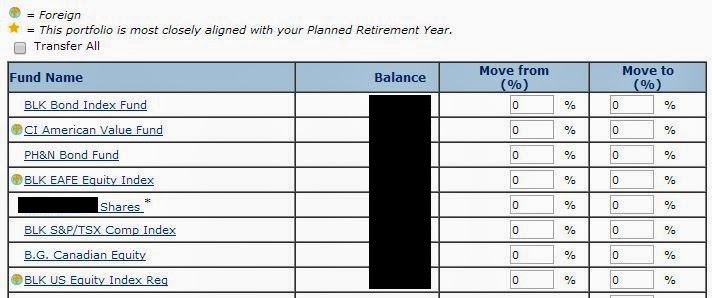

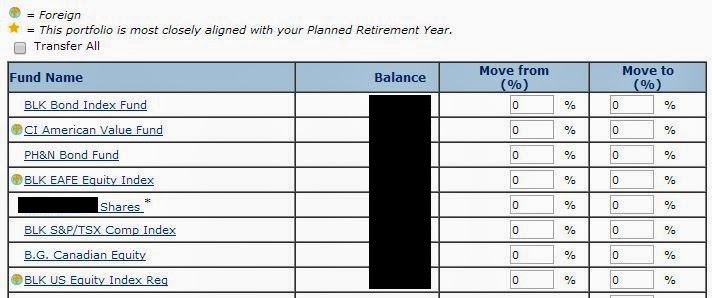

I logged into the site and clicked the option to move the money to other funds.

|

| Seems pretty straightforward. |

This was the first screen I was presented with. It seemed pretty straightforward. I was moving the money out of the non-index funds and into the index funds. It was a matter of entering 100 into all the funds we were selling from the

Move from (%) column and entered the allocation percentage into the

Move to (%) column. Or at least, so I thought.

|

| Entering the percentages. |

Hitting the Continue button on the bottom brought me to a new screen that showed me the new allocation percentages. After looking through them, something wasn't right.

|

| Allocation percentages. |

It seems the allocation percentages on the previous page were referencing the amounts I wanted to reallocate from the funds I was selling and not the target allocation percentage for the overall portfolio. Since we already had index funds in the portfolio, this meant the final percentages would be out of whack. Okay then. That meant I needed to calculate how much I wanted to put in each of the index funds, determine how much I had in the funds, and figure out the amount remaining to allocate. After some spreadsheet wizardry, I calculated the amounts I needed to allocate to each of the index funds.

|

| Well... drats! |

There was the option to enter the amounts as percentages or dollar figures. Since I just calculated the amounts I needed to enter, I selected the dollar figure option and started to enter the amounts. This gave me a new error message. Seems I wasn't allowed to use a decimal point. Nope, I had to round to the nearest dollar. Which didn't make sense as the amounts were in dollars and cents. Since I wanted to sell all the funds, that meant figuring out the total amount of the funds I was selling and calculating the percentage based on that amount to allocate to the index funds. After more spreadsheet wizardry, I figured out the correct allocation percentages.

|

| Entering the correct percentages |

Of course, the percentages all rounded down and ended up at 99%. I had to pick one fund and give it an extra 1%. I selected the BLK US Equity Index Reg to allocate that extra 1%. No particular reason. Most markets have gone up in recent weeks, so no matter which index I selected, it would be higher priced than a month or two before. Although, I suppose there was a reason, the decimal in the percentage calculation was 33.4 or something like that. That was the closest one that could be rounded up based on the .5 round up convention.

|

| The correct allocation percentages. |

After selecting continue, it showed me the new allocation percentage. It wasn't perfect, but it was pretty close. The target investment mix on the right is something that we did a while ago. It was fairly close to our target mix, but we wanted to put a higher percentage into Canadian equities which is why Canadian equity is at 30% and US equity is at 20%.

|

| Final confirmation screen. |

On the last screen, I was presented with the list of transactions that would occur. After reviewing this list, I confirmed the trades and hit Submit.

Overall, this process was fairly simple. The calculations needed to be done were fairly straightforward. However, this could be quite challenging for those not mathematically inclined or those of us who are not spreadsheet gurus.

In any case, the easiest solution would have been to sell everything (including the index funds) and to buy the index funds in the allocations we wanted*. Doing so, however, would have incurred the 2% fee for funds bought in the last 30 days. Probably not a lot of money, but knowing that we paid a 2% fee when it could have been avoided would have been gnawing at me for days.

*I feel this is like trying to buy an extra ticket to a hockey game. However, in order to buy the ticket, I need to sell you all my tickets first before you will sell me one ticket. For example, I have three tickets. I want to buy your one ticket. I sell you my three tickets and then you sell me your four tickets.

Comments

Post a Comment