Avoiding Lifestyle Inflation

|

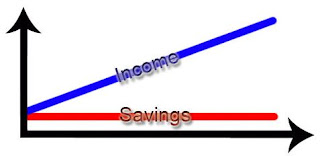

| Generally, this is how most people are affected by lifestyle inflation. |

So why avoid lifestyle inflation?

Well, the short answer is that stuff happens. Maybe tomorrow, next week, or next year, but something might happen with your job, your health, possibly even something with a family member that may cause you to suffer a sudden decrease in income. If that happens, will you be able to keep paying the bills? Or will you be borrowing from Peter to pay Paul?

So what can you do to avoid lifestyle inflation?

It's easy really. Simple to the point that you don't need any further advanced explanations. Keep your spending levels the same. Don't spend more money each month as your income rises.

Further explanations required? Well, let's say, for example, you and your significant other earn $5,000 a month after tax and you spend $3,500 each month. That's $1,500 in savings a month. Hey, that's not bad! Anyway, you just got a raise at work that gives you an extra $1,000 a month after tax. Does that mean you can now spend an extra $1,000 a month to increase your spending to $4,500 a month? Probably. But for the purpose of this post, no. Definitely not! Although saving $1,500 a month is pretty good, saving $2,500 a month is even better!

|

| This is what should happen when you get raises. Instead of keeping your savings level, you should be keeping your expenses level. |

I'm not saying don't treat yourself (I still wouldn't for myself), but don't go overboard where it's a consistent monthly expense.

As I mentioned previously, wifey recently started a new job. As a result, her income is now an extra $400 each paycheque. That's quite a bit of money. Not only that, but now that we're heading in the same direction for our commute, we're spending less money on transit passes. So what did we do with this extra money? Did we celebrate with a fancy dinner out? Did we increase our personal monthly expenses? Did we finally buy that fancy pizza oven they keep selling us on TV? No.

We simply deposited more money into our Questrade accounts.

This is not to say we're completely immune to lifestyle inflation. With the extra money coming in, we determined that we're able to upgrade our internet speed at a cost of $22.60 a month (to $79.04 from $56.44 a month). I debated this internally for a while. However, when there are three separate video streams and a game of mahjong occurring at the same time, having 25Mbps isn't enough. Fortunately, because transit passes no longer need to be purchased, our monthly expenses are actually going down overall (a weekly transit pass is $61 a week plus wifey needed to spend $1 a day extra to board the express bus). Despite the overall decrease in expenses, I still agonized over spending the extra $22.60 on internet upgrades.

Anyway, bank the raises and future you will thank you for it.

Otherwise, you'll be stuck in the rat race until you're 65 (or older) and have nothing to show for it except for a pitiful amount in CPP, OAS, and the GIC. (Possibly even the ORPP in you're in Ontario and if they decide not to scrap it by the time they are supposed to implement it in 2017).

Comments

Post a Comment