The Folly of Timing the Real Estate Market

|

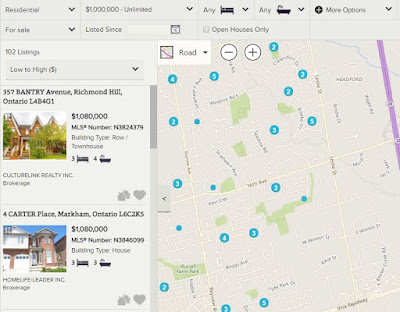

| Disclaimer: Not our neighbourhood. |

Back in March, our neighbours started to renovate their half of the semi-detached we share. This was memorable as baby girl was still very young and wifey was worried the noise would be too much for her when she tried to take her nap. For anyone who has gone through a renovation, there's a lot of construction noise involved. We figured the neighbours were renovating their basement. Turns out, they renovated the kitchen, master ensuite, and foyer as well. That was a lot of renovating.

Wifey surmised that the neighbours were planning on listing their house for sale. At the time, the prices in our area for a semi-detached was exceeding $900,000. Once semi-detached actually sold for $930,000! She was thinking the neighbours were looking to cash out now, move back to their home country (Singapore), and retire. It was a solid plan as theoretical plans go. The neighbours were the original home owners. Assuming they purchased the house originally for $300,000, then they should still have $100,000 or so left on the mortgage right? After the mortgage, fees and taxes, if they sold the house for $900,000, they'd have around $700,000 in capital gains tax free, right? If they have been diligent savers, they could be over $1 million in financial assets once the sale of their home closes.

I gave the neighbours the benefit of the doubt. I mean, we renovated our basement the previous year and we weren't planning on selling the house. Perhaps the neighbours needed more living space? For a family of two adults with no kids, that's possible if they own mountains of stuff.

Well, it turns out that wifey was right. From what intelligence gathering my mother-in-law did, the neighbours planned to sell the house... and then buy another one further north. It was either buy another one or they already bought one further north. They details aren't too clear as the neighbours don't speak Mandarin as fluently as someone from Mainland China. Not only that, but they also planned to continue working.

Hmmm...

I don't know what the neighbours do or where they work, but unless they planned on moving closer to work, it doesn't make much sense (at least to me) to move further away. As it stands, the neighbours already leave the house at 6:00am for their morning commute.

Anyway, one of the other neighbours recently had a basement renovation done as well. Without a permit, the renovation cost them $30,000. Our direct neighbours probably spent closer to $40,000 with a foyer, kitchen and bathroom. I'm only assuming $10,000 for a foyer, bathroom, and kitchen. It can't be that much more, right?

Well, that's okay since $40,000 is a drop in the bucket compared to the $900,000 you can bring in after selling the house!

However, first you have to finish renovating and cleaning and...

And you have to hope the Government doesn't try to step in.

In short, mid-April the Ontario Government introduced a 15% foreign buyers tax. While there aren't a lot of foreign buyers in Toronto (or the GTA), the introduction had the immediate effect of cooling down prices.

Whoosh! Just like that, buyers were now being more careful. Instead of putting down the most money on the first house with no conditions (like no inspections, upon mortgage approval, etc.), buyers are now being choosey.

What does this have to do with the neighbours? Well, they listed their house in early June. The list price has gone up two times (we don't understand why*). However, the house remains unsold. It's been 6 weeks. They have people look at the house from time to time, but no offers that appealed to them.

The funny thing wifey noted in all this? If the neighbours just listed their house in March, instead of renovating, the house would have sold within the week for more than their current asking price.

In addition to that, they wouldn't have to finance a $40,000 renovation.

Much like everything else, there's no timing the real estate market. Who could have predicted the Government stepping in when they did?

For the sake of the neighbour's financial health, I hope they also didn't purchase that house up north before they sold their current home. They'd either need to carry two mortgages at the same time or walk away from their deposit.

*In addition to our direct neighbours, another neighbour 3 doors down decided they needed to be closer to their parents in Oakville. They too just had a newborn and the mother was going back to work soon. As a result, they also listed their house for sale. However, their list price is much lower than our direct neighbour. I don't think our direct neighbour will be selling their house before the neighbour 3 doors down.

Comments

Post a Comment